SpaceX IPO 2026 โ เคเฅเคฏเคพ เคนเฅ IPO? / What Is It?

โก๏ธ IPO (Initial Public Offering) ka matlab hota hai ek company apne shares ko public market me list karna, jisse general investors (retail + institutional) company ke shares kharid sakte hain.

โก๏ธ SpaceX, Elon Musk ki privately-held aerospace and satellite company, 2026 me IPO launch karne ki planning me hai โ jo possibly history ka biggest IPO banega.

๐ช Why Itโs Big:

-

SpaceX duniya ki sabse valuable private company ban chuki hai โ valuation private markets me $800B-plus tak rahi hai aur future IPO me $1โ1.5 trillion tak ja sakta hai.

-

IPO se pehli baar regular investors ko SpaceX shares milenge.

-

IPO ek major financial event hoga global markets ke liye.

๐ IPO Benefits / IPO ke Fayde

๐ก 1) Retail Investors Can Own SpaceX

IPO se aap jaise chhote investors bhi SpaceX ke shares buy kar sakte ho โ jo pehle sirf insider investors, funds, aur employees ke paas the.

๐ฐ 2) Potential for Growth Returns

Agar SpaceX ka business future me strong perform karta hai (Starlink, Starship, data centers), to long-term investors ko significant returns mil sakte hain.

๐ 3) Visibility & Liquidity

Public market me aane se shares liquidity paate hai โ employees aur early investors ko exit ka option milta hai.

๐ 4) Funding Big Missions

IPO funds se SpaceX apne ambitious projects (Mars missions + space AI data centers + Starship production) ko accelerate karega.

๐ธ Profit for Investors / Investors ka Munafa

โ๏ธ IPO Listing Day Pop:

Agar IPO demand strong ho, share price listing ke baad upar ja sakta hai โ jo early investors ko quick profit de sakta hai.

โ๏ธ Long-Term Growth:

SpaceX ka revenue model recurring (Starlink subscriptions), launch services, government contracts aur future tech se strong growth dikhata hai.

โ Risk:

โข Space industry high-risk, high-cost hoti hai โ future earnings predictable nahi hote.

โข IPO ka price aur performance market conditions pe dependent hai.

๐ผ How Much to Start / Kitna Invest Karna Padta Hai

๐ IPO Price Unknown:

SpaceX IPO me per-share price IPO ke waqt decide hoga โ abhi tak official S-1 filing aur price range announce nahi hui hai.

๐ Minimum Investment:

Ye depend karega ki broker aur exchange kya rules rakhta hai โ aksar retail investors ko minimum number of shares purchase karne hote hain.

๐ก Pre-IPO Shares:

Kuch investors private markets me tender offers ya secondary sales se SpaceX shares le sakte hain, par ye generally accredited investors ke liye hota hai.

๐ How Many Shares / Company Size

SpaceX IPO ke total share count aur price per share abhi clear nahi hua hai โ ye IPO filing me reveal hoga.

๐ Valuation Estimates:

-

Private Valuation (2025): ~$800B (secondary share sale)

-

IPO Target (2026): ~$1โ1.5T lai goal

IPO issuer jab publicly list hoga, tab total shares aur price decide honge.

๐ Future Plans / Aane Wale Plans

SpaceX ki strategy includes:

๐ Starlink Expansion: Global satellite internet aur enterprise solutions.

๐ Starship Megarocket: Heavy payloads, Moon & Mars missions.

๐ฐ๏ธ Space-Based Data Centers: AI aur compute platforms orbit me.

๐ Lunar & Deep Space: Infrastructure beyond Earth orbit.

IPO se praapt funds in sab ko push mil sakta hai.

๐ History of SpaceX โ 2002 to 2026

๐ช 2002 โ Founding

Elon Musk ne SpaceX start kiya with vision of reducing space travel cost and eventually reaching Mars.

๐ 2008 โ Falcon 1 Success

First privately funded liquid rocket to orbit โ milestone achievement.

๐ฐ๏ธ 2010s โ Falcon 9 & Reusability

Falcon 9 & Falcon Heavy reusable rockets changed space economics.

๐ก 2015 โ Starlink Launch Begins

Low-Earth orbit (LEO) broadband satellite constellation starts deployment.

๐งโ๐ 2020s โ Record Launches

SpaceX launches hundreds of missions yearly โ dominating global launch market.

๐ 2024โ2025 โ Surge in Value

Private valuation grows from ~$200B (mid-2024) to ~800B by late 2025.

This reflects exponential trust in Starlink revenue and reusable tech.

๐จ 2026 โ IPO Preparation

SpaceX engages banks, aims for IPO raising $25โ$30B+ at a $1โ1.5T valuation โ potentially the largest IPO ever.

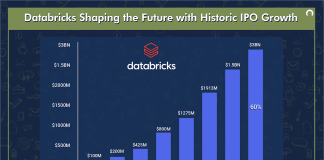

๐ โValuation Graphโ (Text Chart)

Ye text chart dikhata hai SpaceX private valuation journey โ โup and downโ graph jaisa concept:

โก๏ธ Ye chart actual share price nahi hai โ estimated valuation milestones based on tender offers & private sales.

๐ Summary

-

SpaceX IPO 2026 ek historic event hoga jisme public investors first time company shares kharidenge.

-

Benefits: growth access, liquidity, and funding spacecraft & satellite infrastructure.

-

Investor profit depends on long-term execution and market conditions.

-

Investment start amount will depend on IPO pricing and brokerage rules.

-

Future plans are bold: Starlink, Starship, orbital data centers, Mars ambitions.

-

History shows SpaceXโs rise from startup to potential trillion-dollar public company.ย