📌 What Is an IPO (Initial Public Offering)? – IPO क्या होता है?

An IPO (Initial Public Offering) is जब कोई private company अपने shares public investors को बेचती है, यानी वो stock market में trading शुरू कर देती है।

👉 Before IPO – company के shares सिर्फ founders, private investors, और institutions के पास होती हैं. OpenAI IPO

👉 After IPO – आम public investors भी shares खरीद सकते हैं.

IPO का उद्देश्य होता है:

✔ Capital (funds) raise करना for expansion

✔ Growth को accelerate करना

✔ Brand visibility बढ़ाना

✔ Early investors और employees को liquidity देना

📅 OpenAI IPO: Launch Date & Timeline — संभावित तारीख

As of now, OpenAI has not officially announced a fixed IPO date — but here’s what multiple reports suggest:

📌 OpenAI is preparing to file for an IPO potentially as early as second half of 2026, but a listing may actually happen in 2027 depending on market conditions and final readiness.

So 현실 timeline looks like this:

| Year | Event |

|---|---|

| 2025 | Company restructuring; groundwork for IPO begins. |

| 2026 H2 | Earliest possible filing with regulators. |

| 2027 | Most analysts think actual listing might happen here. |

📌 “No date set in stone yet” — OpenAI CEO Sam Altman has said there’s no fixed timeline but going public is likely eventually.

📊 OpenAI Company at a Glance

OpenAI started as a nonprofit, later restructured to a Public Benefit Corporation, now making it easier to consider an IPO while keeping its mission focus.

Key Recent Stats

-

Valuation has grown fast: about $500B from share sales late 2025.

-

Possible IPO valuation targets around $1 trillion (one of the largest ever).

-

Annualized revenue estimated near $20B by end of 2025.

📈 Investor Benefits of an IPO (IPO के लाभ)

1. 🪙 Public Liquidity

IPO से investors को अपने shares को public markets में sell करने का मौका मिलता है, जो private holding से आसान होता है.

2. 📈 Potential Wealth Growth

If OpenAI performs well after IPO, share prices may rise — investors who bought early can see capital gains.

3. 🧑💼 Wider Investor Participation

अब सिर्फ big VCs नहीं, आम retail investors भी OpenAI में invest कर सकते हैं.

4. 💼 Company Growth Capital

Extra funds from IPO can be invested in AI research, infrastructure, global expansion, and new products.

⚠️ Risk Note: IPO stocks can be volatile, especially for AI companies that spend big on R&D.

💰 How Much Might Investors Profit?

Profit depends on IPO price vs future stock price — no fixed numbers yet.

But if shares list at say a high valuation (e.g., $60B+ raised at IPO with total valuation near $1T) and the stock performs well:

➡ Early investor gains could be large — but this is not guaranteed. Gains depend on market demand, financial results, and competition. 📊

📉 Risks & Considerations

📍AI infrastructure is expensive — OpenAI reportedly still operating at losses even with growing revenue.

📍Market conditions can delay IPO or affect share price.

📍Competition from Google, Nvidia, Anthropic and others is intense.

📊 Future Plans (Future Direction, भविष्य की योजनाएँ)

OpenAI has big ambitions:

🔹 Push AI into enterprise solutions, health, science, automation.

🔹 Launch new hardware devices by late 2026.

🔹 Build massive AI infrastructure (data centers, software ecosystems).

These growth drivers could influence the IPO success.

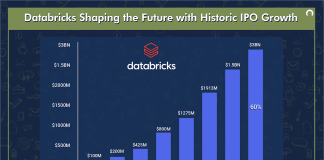

📈 Simple Graph to Visualize OpenAI IPO Journey (For Your Own Image)

You can use this structured data to generate an image chart showing valuation growth and timeline:

-

“Secondary sale hit $500B”

-

“IPO planning begins”

-

“IPO filing window”

-

“IPO listing”

-

“Future revenue growth”

🧠 Quick Summary

IPO kya hai?

IPO ek process hai jahan company apne shares public market mein bechti hai aur investors ko allow karti hai stocks kharidne ka. 📈

OpenAI IPO kab?

Abhi official date nahi hai — reports kehte hain late 2026 se 2027 ke beech IPO possible hai. 📅

Valuation kitni hogi?

Target roughly up to $1 trillion — bahut bada IPO. 💰

Investors ko fayda?

Public market se liquidity, potential profit, aur growth exposure. Lekin risk bhi hai because AI companies high cost and competition mein hain.

Future plan?

Enterprise AI growth, new AI devices, infrastructure spending — IPO se raise ki gayi funds yeh sab accelerate kar sakti hain.