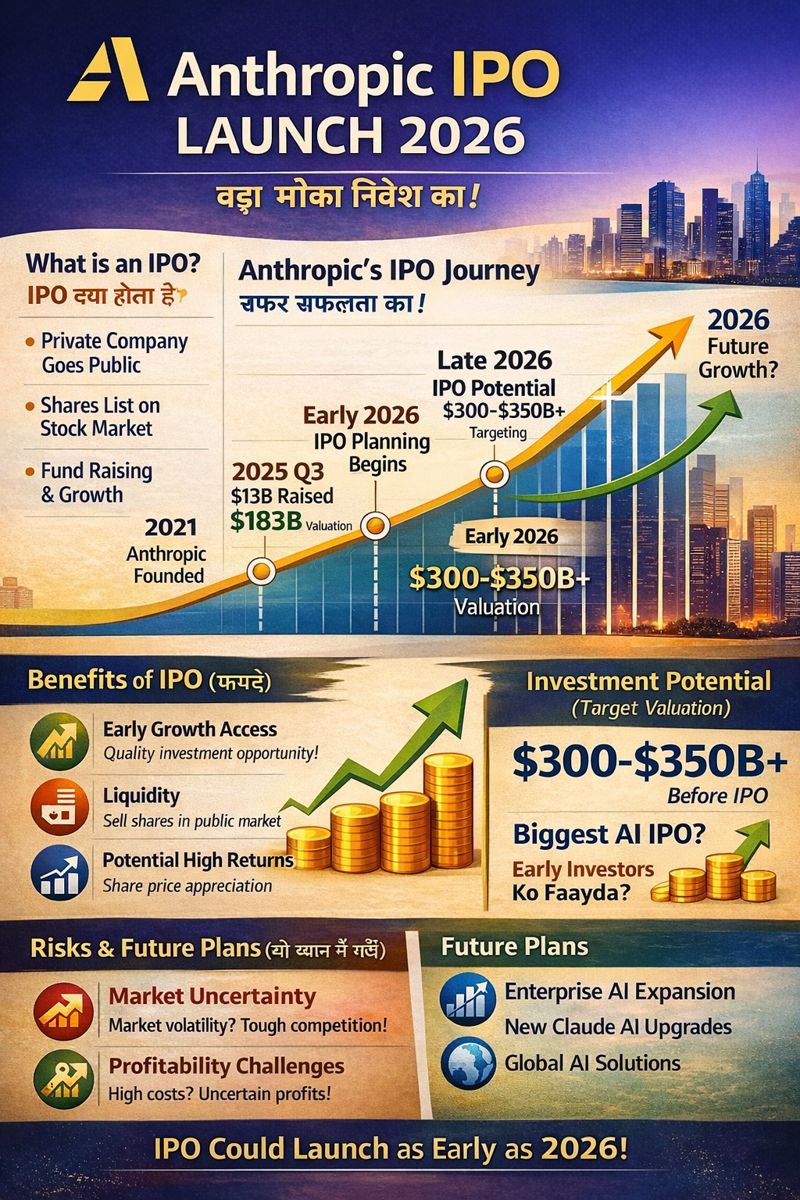

Anthropic IPO 2026: Launch Date & Timeline

Anthropic is preparing for an IPO that could happen as early as 2026, according to reports. पर company ने अभी official date announce नहीं किया है.

📆 Potential Timeline

-

2021 — Anthropic founded by former OpenAI engineers.

-

2025 (Sept) — Raised investment at ~$183B valuation.

-

Late 2025 – Early 2026 — Reports say Anthropic hired IPO lawyers (Wilson Sonsini) and is in early IPO prep.

-

2026 (Optimistic) — IPO could be launched as early as 2026 — though still early stage and not finalized.

-

Late 2026 – 2027 — If market or company delays, IPO might slide into late 2026 or 2027.

Note: IPO timelines depend on audits, bank underwriting, market conditions, and financial performance.

💰 Company Snapshot: Anthropic’s Growth Story

Anthropic is a fast-growing AI startup best known for Claude, a competitor to models like ChatGPT and Google Gemini.

Recent valuation & funding:

-

2025 funding rounds saw valuation rise sharply — reports suggest Anthropic targeting a $300–$350 billion valuation before IPO.

-

Backers include big names like Google, Amazon, Microsoft, Nvidia and institutional investors.

-

Annual revenue projected to grow toward ~$26B by 2026 according to some targets.

This rapid scaling makes Anthropic one of the biggest AI startups eyeing the public markets.

📈 What Is the IPO About — IPO की बात समझिए

IPO क्यों? मुख्य कारण:

✔ Capital raise: नई technology development और enterprise growth के लिए funds मिलेंगे.

✔ Liquidity: Early investors और employees को shares sell करने का मौका मिलेगा.

✔ Brand & global presence: Public listing से company की पहचान और investor reach बढ़ेगी.

IPO = new revenue + liquidity + credibility.

💡 Benefits for Investors — निवेशकों के फायदे

1. 📊 Early Access to Growth

IPO के ज़रिये आम investors Anthropic जैसी high-growth tech company में invest कर सकते हैं.

2. 🪙 Liquidity & Trading

IPO के बाद आप shares को public market में बेच सकते हैं.

3. 📈 Capital Appreciation

अगर company भविष्य में अच्छा performance दे, stock price बढ़ सकता है — जिससे investors को profit हो सकता है.

4. 📌 Portfolio Diversification

AI tech एक rapidly growing sector है — इसका हिस्सा बनना long-term growth के लिए मदद कर सकता है.

🚫 लेकिन ध्यान है कि profit नहीं guaranteed होता — stock markets में risk रहता है.

🤝 What’s in It for Anthropic?

✔ Raise huge capital for AI research and infrastructure

✔ Expand enterprise deals and global footprint

✔ Compete better with rivals like OpenAI, Google, and others

📉 Risks & Challenges (जो ध्यान में रखें)

❗ Market volatility: Tech IPOs volatile होते हैं.

❗ Profitability hurdles: AI infrastructure costs high — profitability अभी भी uncertain है.

❗ Competition: OpenAI, Google, Meta AI आदि से tough competition.

📊 Future Plans — भविष्य की योजनाएँ

Anthropic is working on:

🔹 Improving Claude AI and related products

🔹 Enterprise adoption (business tools & services)

🔹 Global expansion of AI APIs and integrations

🔹 Enhancing safety & scalable alignment research

अगर IPO successful होता है, company growth plans को accelerate करने के लिए capital उपलब्ध होगा.

🧠 Simple Graph to Visualize Anthropic IPO Story (for your image)

Here’s a structured graph concept you can use to design an image:

Graph idea: A rising line from 2021 to 2026, with a steep slope in 2025–2026.