Bolt IPO Launch 2026: Expected Date, Valuation, Stock Forecast & How to Invest

Who Is Bolt?

🎯 Bolt Technology OU, commonly known as Bolt, is an Estonian ride‑hailing and shared mobility platform that competes with companies like Uber across Europe and Africa. The company also provides e‑scooters, e‑bikes, food delivery, grocery delivery, and car‑sharing services. It was founded in 2013 by Markus Villig.

Bolt operates in more than 45 countries with a network of millions of users and drivers. Its diversified model — covering ride‑hailing, micromobility, delivery, and more — has made it one of the largest mobility startups in Europe.

IPO Planning

Reports suggest that Bolt is targeting an IPO as early as 2026, although no specific launch date has been officially confirmed. The company has been exploring options for listing, engaging advisers to assess investor interest, and considering whether to list in Europe or the United States depending on market conditions.

In recent years, Bolt has worked on profitability and financial readiness, securing financing facilities and aligning its business for potential public markets, but the actual IPO timing hinges on favorable market conditions.

📊 Bolt’s Valuation & Business Snapshot

Funding & Valuation History

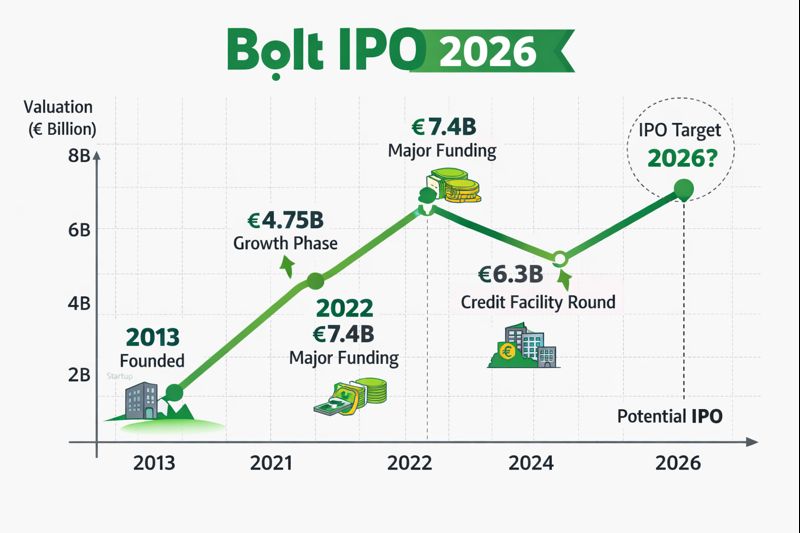

Bolt has raised significant capital over multiple funding rounds:

-

In 2022, Bolt raised €628 million in a major funding led by Sequoia Capital and others, valuing the business around €7.4 billion (~$8 billion).

-

In 2024, Bolt closed a €220 million revolving credit facility with major global banks — a step toward financial maturity and IPO preparation.

-

Industry estimates place Bolt’s latest valuation at around €6.3 billion (~$6.8 billion) after secondary share sales and funding events in 2025.

Revenue & Growth

Revenue has grown steadily in recent years:

-

2021–2024 revenue climb reflects a scaling mobility business, with $2.15 billion in revenue in 2024.

Bolt’s business remains profitable at the operating cash flow level in some regions, although it posted operating losses during aggressive expansion phases.

📅 Bolt IPO 2026 — Timeline (Projected & Reported)

| Year | Milestone |

|---|---|

| 2013 | Bolt founded by Markus Villig. |

| 2022 | Major funding at ~€7.4B valuation. |

| 2024 | €220M credit facility raised to strengthen finances. |

| 2025 | Ongoing IPO preparation, exploring listing options. |

| 2026 (Projected) | IPO timing dependent on market conditions; 2026 remains a key target window. |

📈 What It Means to Go Public — Is Bolt Really Going Public?

Bolt has not officially filed its IPO paperwork, and it has not set a precise IPO date. Market reports indicate it is actively preparing for an IPO in or around 2026 and evaluating where to list. The company’s readiness depends heavily on macroeconomic and market conditions.

📉 Why An IPO Matters for Bolt IPO

✔ Capital Raise: Bolt can raise significant funds for growth in new markets, technology, and infrastructure.

✔ Brand Visibility: A public listing raises global brand recognition.

✔ Liquidity: Early investors, founders, and employees can sell some of their shares.

✔ Strategic Growth: Funds from an IPO can accelerate partnerships, acquisitions, and competitive positioning against rivals like Uber and Lyft.

💰 How to Invest in Bolt — Before & After IPO

At present (pre‑IPO), Bolt shares are not publicly traded, but investors can potentially gain exposure via:

-

Secondary markets / private shares (for qualified investors).

-

Venture capital funds that hold Bolt shares.

-

Investment news and tracking before IPO — watch for IPO filings (S‑1 or equivalent) with regulators when they arise.

Once Bolt files for IPO and lists on a public exchange (e.g., NASDAQ or a European exchange), retail investors will be able to buy shares through brokerage accounts.

📉 Investor Benefits & Profit Potential

💡 Going public can provide several advantages:

-

Early Entry Potential: If investors buy at IPO price and the stock performs well, returns can be significant.

-

Visibility: Public companies are subject to financial reporting, giving transparency to investors.

-

Liquidity: Shares can be freely bought and sold on the exchange.

📌 However, investor profit is never guaranteed. IPO prices vary with market conditions, and stock performance after listing depends on revenue growth, competition, and investor sentiment.

📉 Risks of Bolt IPO Investing

⚠️ Market volatility: IPO stocks can swing widely after listing.

⚠️ Competition: Mobility platforms face stiff competition from Uber, Lyft, and local players.

⚠️ Profitability requirement: Companies must demonstrate growth and profitability potential to attract long‑term investors.

🚀 Future Plans for Bolt IPO

Bolt continues to pursue strategic global expansion and profitability improvements:

-

Scaling ride‑hailing, scooters, bikes, food delivery, and car sharing in existing and new markets.

-

Exploring acquisitions and partnerships to strengthen mobility offerings.

-

Working toward profitability and operational maturity as part of IPO preparation.

📊 Simple “Up‑Down” Valuation Graphic — For Your Image

You can use the following structured timeline graph idea for your image:

Year | Valuation (€B or $B)

——————————–

2013 | Startup (foundation)

2021 | ~€4.75B (growth era) :contentReference[oaicite:13]{index=13}

2022 | ~€7.4B (major funding) :contentReference[oaicite:14]{index=14}

2024 | Secondary events ~€6.3B (estimate) :contentReference[oaicite:15]{index=15}

2026 | Potential IPO target (market dependent) :contentReference[oaicite:16]{index=16}

Visual idea:

-

A line chart from 2013 to 2026 showing the valuation rising, peaking near €7.4B and fluctuating toward the projected IPO window.

-

Add markers for key events: “Founding,” “Major Funding,” “2024 Credit Facility,” “IPO Target 2026.”

📌 5 Quick Summary Points Bolt IPO

-

IPO 2026 Target: Bolt is actively preparing for a potential IPO in 2026 but has not set a confirmed date.

-

Valuation: The company has been valued at around €6.3–€7.4 billion in recent years due to funding and secondary share events.

-

Business Model: Bolt is a diversified mobility platform offering ride‑hailing, scooters, bikes, delivery, and more across 45+ countries.

-

Investor Opportunity: Pre‑IPO investors may benefit from growth, but IPO performance will depend on market conditions and profitability.

-

IPO Benefits: Public listing can provide capital, liquidity, and global visibility, but investing carries risk and requires careful evaluation.