The Secrets Behind Zepto Business Unstoppable Growth: Insights & Trends

In less than five years, Zepto has become one of India’s fastest-growing startups. It operates in the rapidly expanding quick-commerce sector, delivering groceries and essentials to customers in minutes rather than hours or days. Its rise reflects changes in consumer expectations, urban lifestyles, and digital adoption, but also highlights the challenges of scaling a capital-intensive business.

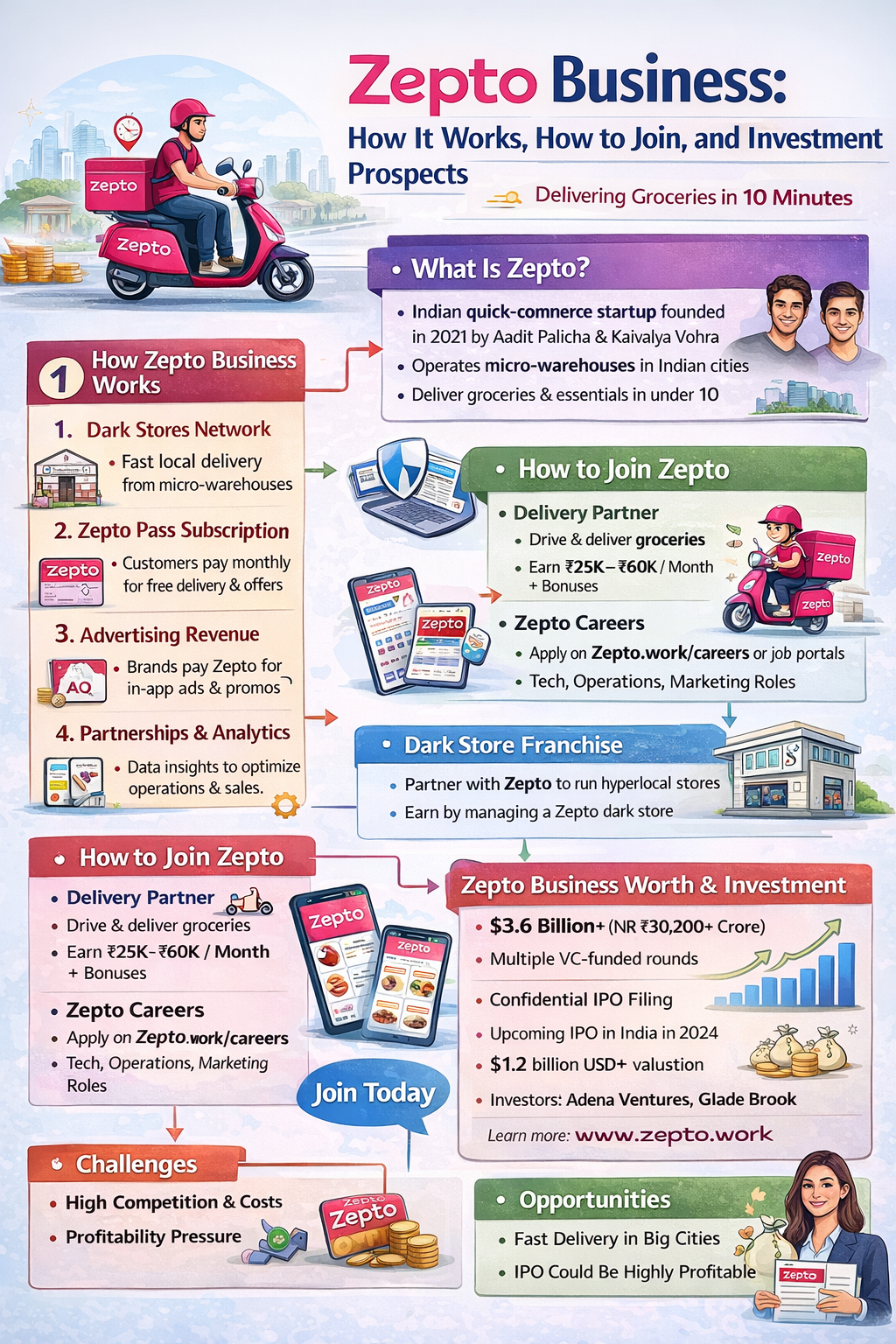

What Is Zepto and How Did It Begin?

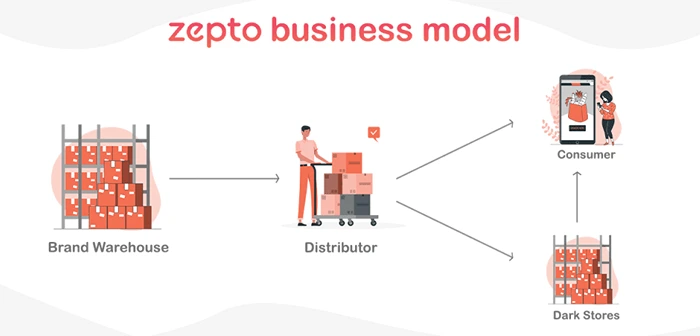

Zepto is an Indian quick-commerce company founded in 2021 by Aadit Palicha and Kaivalya Vohra. The two began the business, originally named KiranaKart, while still teenagers and eventually dropped out of college to focus full-time on building the company. Zepto rebranded and pivoted from partnering with small kirana stores to building its own network of micro-warehouses — known as dark stores — across cities in India.

Today, Zepto operates hundreds of dark stores across multiple metropolitan regions. Its primary promise to customers is 10-minute delivery of everyday essentials including groceries, personal care products, and household items.

How the Zepto Business Model Works

At its core, Zepto is a logistics and retail business built on four key pillars:

1. Fast Delivery via Dark Stores

Zepto builds or leases small, strategically located warehouses near residential areas. These dark stores stock high-frequency items so that orders can be picked, packed, and delivered quickly — usually within 10 minutes of ordering.

2. Product Sales and Margins

Zepto sources products in bulk directly from suppliers or vendors at a lower cost, then sells them at market prices. The difference between the buying and selling price generates primary revenue.

3. Subscription (Zepto Pass)

The company offers a membership program called Zepto Pass that gives loyal customers unlimited free delivery and special deals for a monthly fee. This creates recurring revenue and helps retain users.

4. Advertising and Additional Services

Brands can pay for in-app advertising, premium placement, or data-driven marketing campaigns. Zepto is also expanding into private-label products with higher margins and experimenting with ready-to-eat services like Zepto Café in some cities.

Overall, Zepto’s revenue mix includes product margins, delivery charges, subscriptions, advertising, and value-added services.

Joining or Working With Zepto: How It Works

Zepto’s operations involve both corporate and delivery roles, and there are several ways people engage with the business:

1. Working as a Delivery Partner

Many gig workers join Zepto as delivery partners. These partners use their own vehicles or bicycles to deliver orders, earning wages and incentives based on performance. Some recruitment platforms advertise that delivery partners can earn anywhere from ₹25,000 to ₹60,000 per month, with bonuses and support schemes available.

2. Corporate or App-Based Roles

Zepto also hires for corporate positions including tech, operations, supply chain, and customer service roles. Interested candidates typically apply through the official Zepto careers portal or job sites linked to its corporate offices.

3. Franchise or Business Partnerships

While Zepto is not a traditional franchise business like a retail chain, there are reports of local entrepreneurs exploring partnership opportunities in hyperlocal delivery and dark-store management in select regions.

4. Consumer Use

For everyday customers, joining Zepto’s ecosystem is as simple as downloading the Zepto Now app, registering, and starting orders. The platform supports instant cart checkout and fast deliveries.

Investing in Zepto — Startup Funding and IPO Prospects

Zepto’s fundraising history is one of the fastest among Indian startups:

-

It raised initial seed funds in 2021.

-

Multiple venture capital rounds followed, including Series C, D, E, and later rounds that pushed its valuation into the billions.

-

In 2025, Zepto raised large funding rounds that valued the company at over $7 billion, with significant new capital injected by global investors.

The company has also filed confidentially for an IPO worth more than $1.2 billion, expected to be among India’s most anticipated public listings. This filing marks a transition from private fundraising to a potential public market debut, giving early investors and employees a path to liquidity.

For everyday investors, direct investment in Zepto (pre-IPO) often happens through secondary markets or private equity platforms, but this requires accreditation and access that individual retail investors may not always have.

Financial Worth and Business Sustainability

Zepto’s financial performance is not fully disclosed like a public company’s would be, but available data suggests robust growth:

-

Zepto doubled its revenue to over ₹4,454 crore in FY24 as it scaled operations.

-

It has expanded its Zepto Pass subscriber base into millions of users.

Profitability in quick commerce is notoriously difficult because rapid delivery means high logistics costs — especially wages, fuel, and warehouse operations. But Zepto has focused on optimizing cost per order and expanding high-margin revenue streams such as advertising and private labels.

Is Zepto Business Worth It? — Opportunities and Challenges

Zepto’s business model is attractive because it meets a clear consumer demand for fast service, and its valuation reflects investor confidence in this segment. The company’s growth trajectory shows significant market opportunity.

Opportunities include:

-

Urban customers increasingly prefer fast delivery for grocery and essentials.

-

Membership programs offer recurring revenue.

-

IPO plans provide long-term investor upside.

Challenges include:

-

High operational costs and competition from rivals like Blinkit and Swiggy Instamart.

-

Profitability pressures remain intense as quick commerce logistics are expensive.

-

Regulatory and market risks such as food safety compliance in dark stores.

Conclusion

Zepto has evolved from an ambitious startup founded by young entrepreneurs into a major player in India’s quick-commerce space. For consumers, it delivers convenience; for employees, it offers gig and corporate employment; and for investors, it represents a potential high-growth opportunity. Its IPO plans and strong funding history show confidence in its business model, but like all disruptive tech companies, it must balance growth with sustainable economics.

Zepto business Zepto startup quick commerce India Zepto delivery Zepto business model food delivery startups 10-minute delivery service Zomato IPO hyperlocal delivery startups fastnews123 business