Databricks IPO Launch 2026: Expected Date, Valuation, How to Invest & Future Growth

Databricks is a leading American enterprise software company founded in 2013 by the creators of Apache Spark. It provides a unified data and AI (artificial intelligence) platform — often called a data lakehouse — that combines data warehousing, analytics, and machine learning. Databricks serves thousands of clients worldwide, including major enterprises, helping them analyze massive datasets and build advanced AI models.

📅 Company History & IPO Context

📜 Timeline (First Day to Present)

| Year | Event |

|---|---|

| 2013 | Databricks founded by creators of Apache Spark. |

| 2021–2024 | Multiple funding rounds and platform expansion. |

| 2024 | Closed a large funding at ~$62 billion valuation. |

| 2025 | Raised ~$4 billion Series L at ~$134 billion valuation. |

| Late 2025/2026 | IPO talk intensifies as company readies public listing if market conditions align. |

Databricks has not publicly filed its IPO paperwork (S‑1) as of late 2025/early 2026, but top executives and market analysts believe a late 2025 to early 2026 IPO launch is possible if the public markets are receptive to large enterprise tech deals.

📈 IPO 2026 — Is Databricks Going Public?

As of now, Databricks has not announced an official IPO date nor filed with the U.S. SEC. The CEO and leadership have stated publicly that the company will go public “when market conditions are right,” indicating flexibility rather than a fixed date. Analysts forecast a potential IPO window in early to mid‑2026 based on market interest and strong private funding momentum.

💰 Databricks IPO Valuation (Expected)

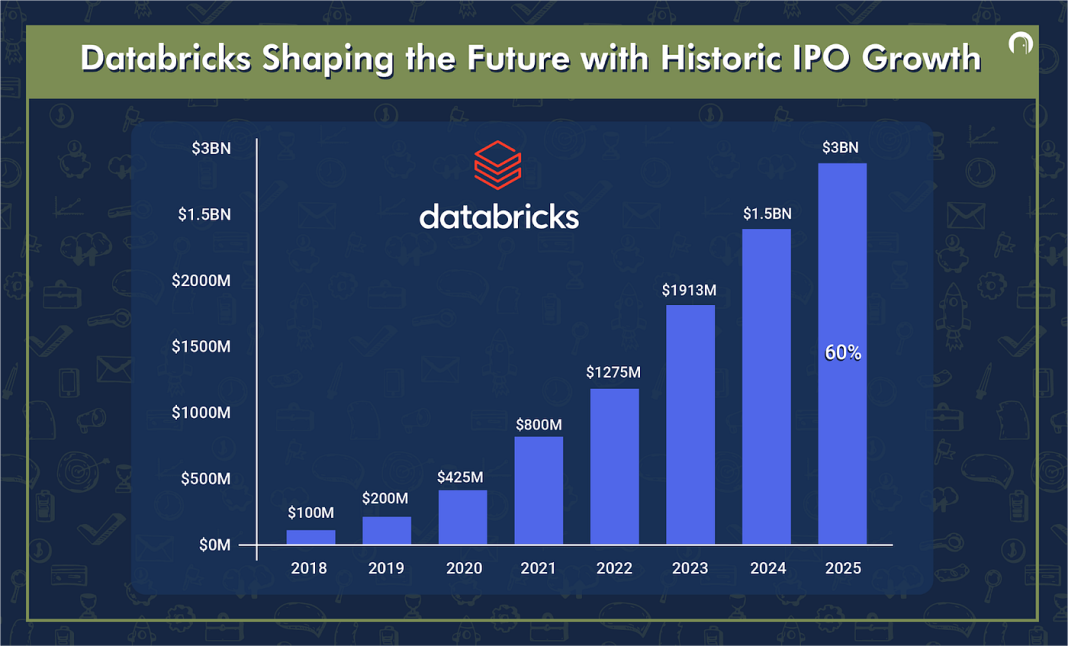

Databricks has seen massive valuation growth through private funding in recent years:

🔹 December 2024: Raised capital valuing the company at ~$62 billion.

🔹 September 2025: A ~$1 billion Series K funding round pushed valuation above $100 billion.

🔹 December 2025: A $4‑billion Series L funding round lifted the valuation to approximately $134 billion.

Industry analysts suggest that Databricks could seek a similar or higher valuation at IPO, potentially in the $100 billion–$140 billion range when it goes public.

📊 How to Invest in Databricks Before & After IPO

🎯 Before IPO

Before the public listing:

-

Accredited investors may access pre‑IPO shares through secondary markets or private stock platforms.

-

Early employees and funds may sell shares via tender offers before public trading begins.

-

Platforms like EquityZen or SharesPost sometimes list private shares to qualified investors (not guaranteed).

Retail investors cannot currently buy Databricks shares until it lists on a public exchange.

📈 After IPO

Once Databricks files its IPO (S‑1) and lists on an exchange (likely Nasdaq), public investors will be able to buy and trade shares through regular brokerages.

🧠 Benefits of Investing in Databricks IPO

💡 Growth Potential: A company with a $134 billion valuation and strong AI/data platform could see price appreciation post‑IPO.

💡 First‑Mover Advantage: Early public investors often benefit if the market values the company at higher multiples.

💡 Liquidity: Transforming private shares into publicly tradable ones gives investors flexibility.

💡 Enterprise SaaS & AI Demand: Strong demand for analytics and AI tools supports long‑term growth.

⚠️ Risks & Considerations

❗ Market Volatility: Tech IPOs can be volatile, especially in uncertain macro environments.

❗ Competition: Rivals like Snowflake, Palantir, and cloud providers could impact long‑term profit margins.

❗ No Guarantees on Timing: Leadership may delay the IPO if markets weaken.

🌐 Future Plans — Databricks Beyond IPO

Databricks expects to continue expanding its product suite for data engineering, analytics, and AI:

✔ Broaden Lakehouse platform adoption across industries.

✔ Launch new AI‑driven tools like Agent Bricks and Lakebase for enterprise AI workflows.

✔ Expand global presence and partnerships with major cloud providers.

✔ Drive deeper enterprise penetration with Fortune 500 clients.

These initiatives could strengthen the company’s case for a strong IPO debut.

📊 Image Graphic Concept — Databricks IPO 2026 (Up‑Down Trend)

Here’s a text prompt to generate your image:

Create a visual infographic titled “Databricks IPO Launch 2026 – Valuation & Timeline.” Include a line graph showing valuation growth: 2013 (founded), 2024 (~$62B), 2025 (~$100B), Dec 2025 (~$134B), and projected 2026 IPO target. Add “IPO 2026?” callout with up/down arrows, icons for tech & AI, and labels for major funding rounds.

This concept helps visually show how Databricks’ valuation has risen and why 2026 is the potential IPO window.

📌 5 Quick Summary Points

-

IPO Window Target: Databricks has not filed yet but is widely expected to consider an IPO in early to mid‑2026.

-

Massive Valuation Growth: Recent funding rounds placed its valuation near $134 billion, signaling strong investor confidence.

-

AI & Data Platform Leader: The company’s unified data and AI lakehouse platform drives high enterprise adoption and revenue growth.

-

Before IPO Access Limited: Retail investors must wait for public listing, though accredited investors might buy pre‑IPO shares.

-

Future Plans: Continued product innovation, AI expansion, and global partnerships support long‑term growth prospects.

Databricks IPO date Databricks IPO valuation Is Databricks going public How to invest in Databricks before IPO Databricks ipo launch date how to invest in Databricks pre-IPO Databricks future growth potential buying Databricks shares after IPO