Dataiku IPO 2026: Expected Date, Valuation, How to Invest & Future Plans

Dataiku is a French-American AI and machine learning platform founded in 2013. The company builds software to help enterprises design, develop, and deploy advanced AI and data analytics applications. Its flagship product, Dataiku Data Science Studio (DSS), enables data engineers, scientists, and business users to collaborate on data workflows and machine learning projects at scale.

Headquartered in New York with offices around the world, Dataiku serves hundreds of enterprise customers across sectors such as healthcare, finance, manufacturing, and retail. Its customers include major global brands that leverage AI for mission-critical analytics.

📜 First Day to Present — Company History

2013: Dataiku founded in Paris by Florian Douetteau and cofounders.

2015–2019: Early funding rounds build momentum in North America and Europe.

2021: Series E — $400M funding led by Tiger Global, valuation ~$4.6B.

2022: Series F — $200M raised at a ~$3.7B valuation led by Wellington Management.

2025: Annual recurring revenue grows above ~$300M-$350M; banking partners selected for IPO prep.

📈 Is Dataiku Going Public in 2026?

Yes — Dataiku is preparing for a potential IPO in 2026. In October 2025, Reuters reported that the company had hired Morgan Stanley and Citigroup as lead banks to push ahead with a U.S. IPO plan. The anticipated IPO could happen as early as the first half of 2026, though exact timing and final details still depend on market conditions.

For now, Dataiku remains private, but selecting underwriters and exceeding significant revenue milestones are strong signals of intent toward a 2026 public listing.

📊 How to Invest in Dataiku

Dataiku’s most recent confirmed valuation comes from its 2022 Series F funding at ~$3.7 billion. Analysts expect that, depending on revenue multiples and current market sentiment, Dataiku could aim for a valuation between ~$6 billion and ~$9 billion by IPO — driven by enterprise AI demand and recurring revenue strength.

This potential valuation range aligns Dataiku with other enterprise AI platforms and places it among significant mid-sized public tech listings if the IPO proceeds as planned.

💰 How to Invest in Dataiku Before & After IPO

🪙 Before IPO

Retail investors cannot yet buy Dataiku shares because the company remains private. Accredited investors may sometimes access pre-IPO shares through secondary markets (e.g., fundraising platforms that handle private equity), but those are limited and typically available only to institutional or accredited investors.

📈 After IPO

Once Dataiku completes its IPO (likely on a U.S. exchange such as Nasdaq), retail investors can buy shares through regular brokerage accounts like Robinhood, Fidelity, Schwab, or E*TRADE. This public listing opens the company to broader investor access and liquidity.

💡 Benefits of Dataiku IPO

✔ Capital for Expansion: Funds raised can accelerate product development, global reach, and AI research.

✔ Liquidity: Early investors and employees gain the ability to sell shares publicly.

✔ Growth Credibility: Public markets typically reward transparency and performance.

✔ Institutional Interest: A public listing can attract long-term institutional investors.

📉 Profit and Risk for Investors

Profit Potential:

Investors who buy Dataiku stock at IPO may profit if the company’s post-IPO performance strengthens its stock price, driven by revenue growth, enterprise adoption, and AI market tailwinds.

Investor Risks:

⚠ Market volatility — tech stocks can fluctuate sharply after IPO.

⚠ Regulatory and macroeconomic conditions can delay IPO or impact valuation.

⚠ Performance expectations — public markets demand strong quarterly results.

No investment return is guaranteed — IPO performance varies.

🚀 Future Plans After IPO

Even after going public, Dataiku is expected to:

🔹 Expand its AI and analytics platform with new product innovations.

🔹 Grow global enterprise customer base across industries.

🔹 Pursue strategic partnerships with cloud and AI leaders.

🔹 Invest in scalability for large datasets and AI operations areas.

These initiatives could support long-term growth and broaden appeal to enterprise clients and stock market investors alike.

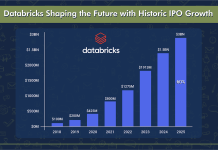

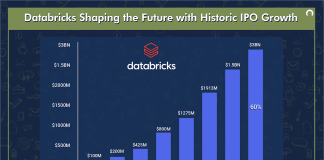

📊 Dataiku expected valuation 2026

You can use this prompt to generate an infographic:

This visual helps readers see historical valuation and future IPO prospects clearly.

📌 5 Quick Summary Points

-

IPO Target: Dataiku is preparing for a potential IPO in early 2026, selecting Morgan Stanley and Citigroup as lead banks.

-

Company History: Founded in 2013 as an AI and data analytics platform with rapid enterprise adoption.

-

Valuation: Most recent valuation was ~$3.7B; IPO valuation could be $6–$9B on public markets.

-

Investment Access: Before IPO, shares are private; after IPO, retail investors can buy through brokerages.

-

Future Outlook: Post-IPO, Dataiku will focus on AI innovation, global growth, and enterprise expansion

Dataiku funding rounds Dataiku stock market 2026 IPO plan enterprise software AI analytics landscape Dataiku IPO 2026 AI investment tech IPO how to invest in Dataiku IPO Dataiku expected valuation 2026 future plans of Dataiku after IPO